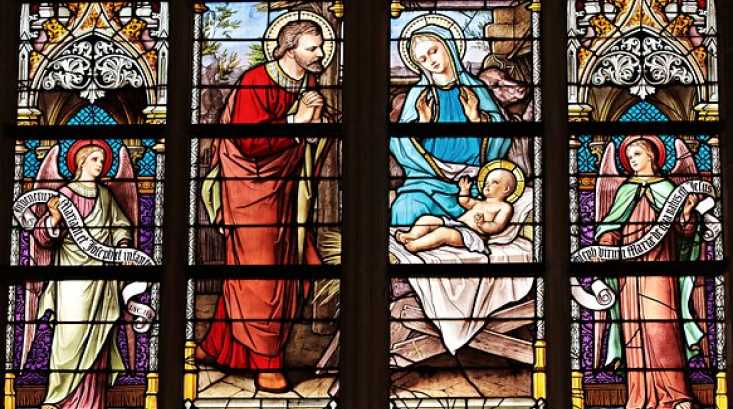

Catholic Community Foundation

Your Catholic Philanthropy Connection

our mission

Our mission is a simple one: Like the parable of the talents, the Catholic Community Foundation’s commitment is to Service, Accountability and Results.

Our Faith precedes Policy and Practice and calls us to a higher level of Stewardship.

The Catholic Community Foundation

We are called to Stewardship and Service. We offer Endowments, Donor Advised Funds and Agency Investment Funds to entities of the Roman Catholic Church.

OUR SERVICES

We offer managed giving vehicles to donors wishing to support Catholic ministries through endowments, donor advised funds, testamentary and planned giving or outright gifts.

Our programs

Since 2006, we have been connecting charitable individuals, families and businesses to non profits and student scholars through over 160 funds and over $100 Million in assets.

Supported Ministries

The Catholic Community Foundation supports and assists ministries through the management of funds and/or an endowment.

Good Shepherd Legacy Society

As a Legacy Society member, you become both a witness and a participant in reaffirming the ministries of our faith as you fulfill the Baptismal call to be leaven in the world, salt of the earth, and a light to our nation.

Where to find us

Catholic Community Foundation

111 Barilla Place,

San Antonio, Texas 78209

Telephone: (210) 732-2157

Fax: (210) 828-5826

Email: [email protected]

Endowment Funds

When you entrust your funds to the Catholic Community Foundation, they grow through socially responsible investments managed by financial experts and are reinvested by you for the good of the Catholic community.

Select a Catholic organization truly meaningful in your life and create or add to the endowment fund that provides that Catholic organization with support in perpetuity.

MORE ABOUT US